Kenbridge Nickel Project

Kenbridge Nickel Project

Kenbridge Nickel Project

Kenbridge Nickel Project

Kenbridge Nickel Project

Kenbridge Nickel Project

Kenbridge Nickel Project

Kenbridge Nickel Project

Ownership: 100%

Commodities: Nickel, Copper, Cobalt

Location: NW Ontario

Status: Advanced Nickel Project

Next Steps: Surface exploration

First Nations Consultation: Ceremonial Blessing

Preliminary Economic Assessment (PDF)

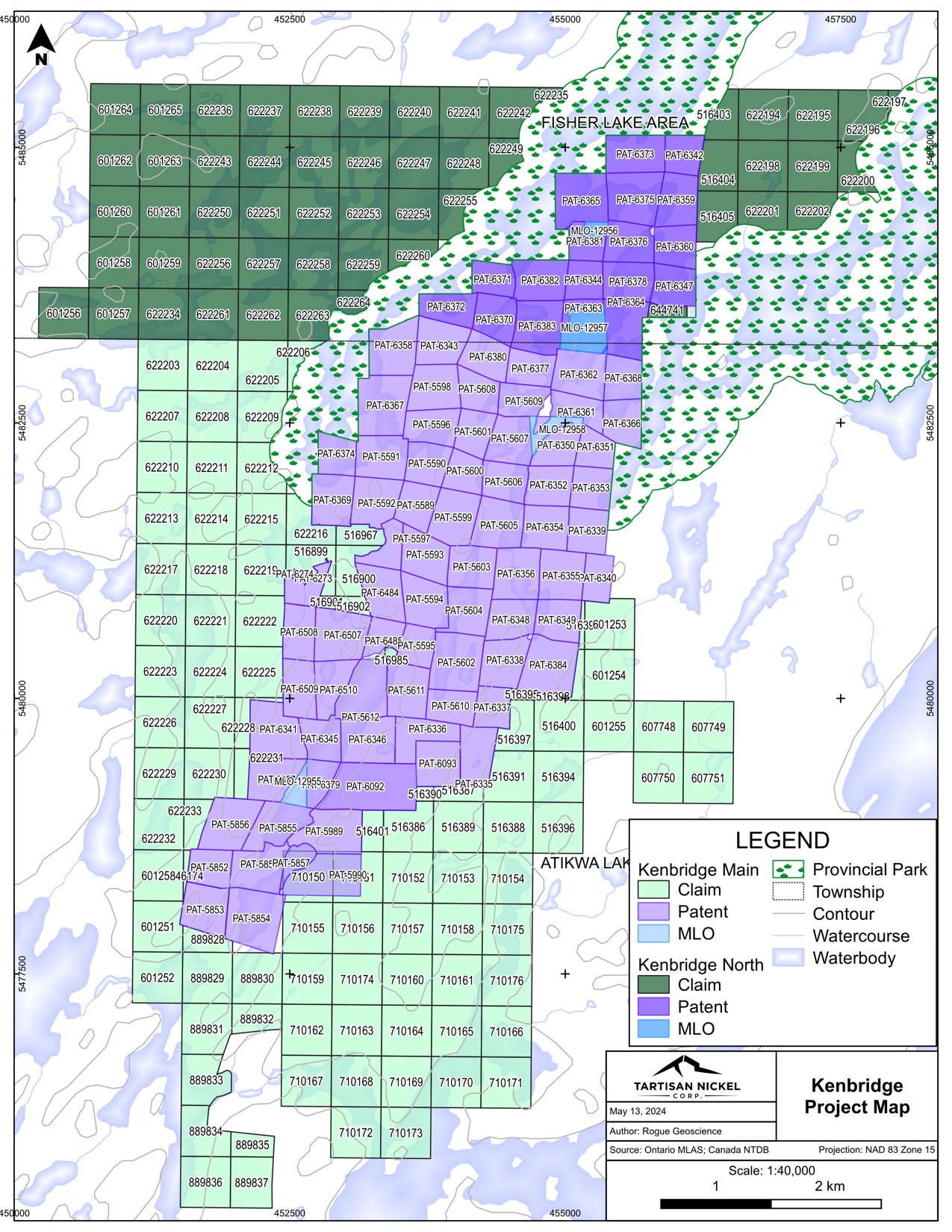

The Kenbridge property is in the north-central part of the Atikwa Lake area and the south-central part of the Fisher Lake Area, Kenora Mining Division, approximately 70 kilometres east-southeast of the Town of Kenora, in northwestern Ontario, Canada. The property is accessible via gravel roads from paved Highway 71.

The Project has seen two distinct periods of underground development and production

The Kenbridge Nickel Project is covered by patented and unpatented mining claims totaling 4,273 ha. Most of the property is covered by 93 contiguous Patented Mining Claims with mining and surface rights or only mining rights, and 4 Mining Licenses of Occupation with only mining rights. In addition, there are 153 unpatented single cell mining claims. The Kenbridge Deposit is covered by Patented Mining Claim PAT-5599 and PAT5593.

The Archean aged Kenbridge Nickel Sulphide deposit (“Kenbridge Deposit”) occurs within a vertically dipping, lenticular gabbro and gabbro breccia with surface dimensions of greater than 250 metres strike length by up to 95 metres in width and has been traced through historical drilling to greater than 1,000 metres in depth. The host volcanic rocks on the western side of the deposit are mostly composed of medium green, strongly foliated and sheared, tuffaceous units with fragments defined by a lensoid banding of matrix carbonate. A very fine-grained massive green rock, possibly a flow or well-indurated tuff, is given the field name of greenstone and occurs throughout the volcanic sequence. Volcanic rocks on the eastern side of the deposit are characterized by larger fragments and less foliation. Contacts between the mineralized gabbro and the enveloping volcanic rocks are marked by a variable thickness of talc schist (1-30 m). The talc may or may not be mineralized.

Underground development of the Kenbridge Deposit extends from surface to a depth of 623 metres in a 3-compartment shaft, with 244 metres of drifts and 168 metres of crosscuts at the 110 and 150 metre levels. The minimum drill spacing is 15.2 metres on all levels. The deepest hole extends to 974 metre depth and intersected mineralization grading 3.18% Ni, 0.19% Cu / 1.05m, including 7.73% Ni, 0.16% Cu / 0.35m (Zone A) and 0.85% Ni and 0.54% Cu / 7.8m including 1.15% Ni, 0.71% Cu / 4.0m (Zone B), indicating that the deposit remains open at depth. Historical surface drilling was completed at 30.5 metre spacing.

The mineralized zone has a strike length of about 250 metres as indicated by drill data. This mineralization has been investigated in detail on two underground levels and with drilling to a depth of 823 metres. Mineralization (pyrrhotite, pentlandite, chalcopyrite ± pyrite) is found to be massive to net-textured and disseminated sulphide zones, primarily in gabbro with lesser amounts in gabbro and talc schist. Nickel grades within the deposit are proportional to the total amount of sulphide with massive sulphide zones locally grading more than 6% Ni. Mineralization undergoes rapid changes in thickness and grades. At least three sub-parallel mineralized zones were intersected in the current drilling and range in thickness from 2.6 m to 17.1 m. Kenbridge is classified as a gabbro-related nickel sulphide deposit.

Management is planning to conduct a resource expansion drill program to further test the deposit at depth and upgrade Inferred Resources to Indicated status in 2024. Baseline studies for project permitting and road construction are continuing, and an MT Survey is budgeted for in the summer or 2024.

Budgeted expenditures total approximately $7,800,000 plus contingency to December 31, 2024. Updating historical documents was made a priority and P & E Mining Consultants Inc. have updated corporate information and disclosure (NI43-101 & 43-101F1) in a report entitled “Technical Report and Updated Mineral Resource Estimate (MRE) of the Kenbridge Nickel Project, Northwestern, Ontario” dated September 17, 2020 (SEDAR+). Subsequently the MRE has been modified and amended as of June 1, 2021. That amended report recommended a program and budget for Kenbridge of $4,300,000 (plus contingency) primarily directed at diamond drilling and geological/geophysical work to expand the size of the Mineral Resource. Those recommendations were followed up with the summer 2021- spring 2022 program. The following work was completed and, in some cases, ongoing.

- Assay rock and core samples for precious metals, particularly Pd, Pt and Au.

- Collect more bulk density measurements from the various host and wall rock types and metal grade ranges.

- Engaged a metallurgical consultant to examine the previous and historic test work studies to plan and executefurther test work programs. Future test work programs should include: continued copper nickel separation tests with the objective of producing higher grade copper and nickel concentrates; a mini-pilot plant program to include column copper nickel separation to prove that copper concentrates containing less than 1% Ni can be produced; and magnetic separation tests on the copper and nickel concentrates to determine whether the magnetic pyrrhotite can be effectively removed and the concentrates upgraded with minimal reductions in copper and nickel recovery. If warranted, consideration should be given to recoveries of precious metals. Mineralized material sorting studies could also be considered.

- Various environmental consultants have been hired to examine historic baseline survey results and re-establish environmental baselines. Terrestrial studies and aquatic data for 2022, 2023 and 2024 are on-going. All Geotechnical Data has now been received as of December 2023. Core samples were sent to SGS Environmental in Lakefield, ON. These environmental aquatic and terrestrial surveys are meant to provide a baseline database for future Project permitting requirements. Engage a geotechnical consultant to improve rock mechanics information for potential open pit slopes and underground openings stability. The geotechnical program should also be designed to provide geotechnical information on the sites of possible facilities (tailings dam, processing plant, ore-waste, and water management) and review Ontario government regulations pertaining to open pit and underground mining operations.

- Perform acid rock drainage studies on representative waste rock samples to better determine the potential for acid generation and groundwater contamination. This work has been initiated with results pending.

- Community relations program with local First Nations have been ongoing with, nearby communities, and pertinent government regulatory agencies, particularly with regards to road access work.

- Completed an Updated Preliminary Economic Assessment of the Kenbridge Project, Sedar+ August 26, 2022.

- Extensional drilling to expand the size of the Updated Mineral Resource and mineralized zones was completedin 2021, results of which were incorporated into the PEA.

- Inverted results of the 2008 VTEM survey for 3-D geological interpretation identified areas for ground TimeDomain Electromagnetic surveys (TDEM). Three areas were identified outside the immediate Kenbridge Deposit area 3 kilometres to the north. These include the KB North, KB East, and KB West areas. KB North was surveyed with the TDEM system identifying 2 separate conductors. Follow up diamond drilling with 4 holes identified similar rock types to those hosting the Kenbridge Deposit, however no significant results were returned in shallow holes. KB East and KB North will be surveyed with the TDEM system in 2024.

- Downhole TDEM was utilized and identified several conductive targets which require follow up. Ground and borehole geophysical surveys were completed on the property and a 10,737m diamond drilling program was completed on the Kenbridge Deposit and the Kenbridge North target in 13 diamond drill holes.

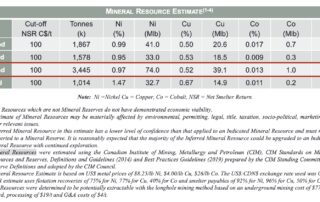

On August 29, 2022, the Company announced the completion and filing of the PEA for the 100% owned Kenbridge Nickel Project, Northwestern Ontario (SEDAR+ August 26, 2022) independently completed by P&E Mining Consultants. This PEA is focused solely on underground mining of the Mineral Resources at the Kenbridge Nickel Project and provides a solid base case for moving the Kenbridge Nickel Project forward. The PEA indicates a 9-year mine plan based on a 1,500 tonne per day underground mining and processing operation, which would have the capacity and could potentially accelerate to 2,000 t.p.d.. The mine plan assumes the potentially extractable tonnage of Measured, Indicated and Inferred Mineral Resources which assumes overall dilution of 47% (18% internal dilution from stope designs plus 29% external dilution) and a 94% mine recovery factor. Measured and Indicated Mineral Resources represent 3,445,000 tonnes at 0.97% Ni, 0.52% Cu and 0.013% Co (74 Mlb Ni, 39.1 Mlb Cu). Inferred Mineral

Resourcesrepresent1,014,000tonnesat1.47%Ni,0.67%Cuand0.011%Co(32.7MlbNi,14.9MlbCu). Metalprices are based on long-term industry consensus forecast with nickel representing the primary contribution to revenues. USD metal prices used in the PEA were USD$10/lb Ni, USD$4/lb Cu and USD$26/lb Co. A $USD: $CDN exchange rate of 0.78 is applied.

LOM revenues from net smelter returns are estimated at $837 million. LOM operating costs are estimated at $292 million. Mining costs are estimated at $38.93per tonne mined, processing costs are $17.74 per tonne and G&A costs are $7.96 per tonne. Cash operating costs are estimated at US$3.76/lb NiEq and all-in sustaining costs (“AISC”) are US$4.99/lb NiEq. LOM capital costs are estimated at $227 million and include pre-production capital costs of $133.7- million. Pre- tax Net Present Value (“NPV”) is estimated at $182.5 million using a 5% discount rate. The Pre-tax Internal Rate of Return (“IRR”) is 26%. The payback period is 3.5 years on an after-tax basis.

First Nations Consultation-Ceremonial Blessing

- Treaty # 3: 28 First Nations under one flag, 55,000 sq. mile traditional territory

- Company has been engaged with Treaty # 3 since May 2007. Recognized and is participating in Great Earth Law authorization process

- Canadian Arrow Mines Limited (wholly owned subsidiary of Tartisan) received first ever Great Earth Law authorization for a resource company from Treaty # 3 Grand Council for the Kenbridge access road construction

- Recognized by Ogichidaa (Grand Chief) as a leader in Aboriginal relations

Treaty # 3 Communities near Kenbridge

- Naotkamegwanning (Whitefish)

- Northwest Angle # 33

- Northwest Angle # 37

- Onigaming